All aboard our Money Milestone Express! In 7 steps, you can build a strong financial future. Your financial success is under your control!

To close the racial wealth gap and strengthen our zip codes, taking action to build our #FinancialLiteracy is key. Let’s share these tips to increase our financial well-being.

The way you start the race is just as important as all the steps you take during the race. From the very beginning, meaning your very first paycheck, start saving. Saving early is a crucial step toward developing healthy financial habits.

Small amounts set aside into a dedicated account can start to accumulate wealth and create a buffer for unexpected expenses.

Take advantage of our BankBlack Savings with no fee with at least one direct deposit during the month. Set up an automatic savings plan!

Once you’ve developed a habit of saving, it’s time to create a spending plan. A spending plan helps you manage your money, so you don’t overspend and slip into debt.

To create a spending plan, start by tracking your expenses and categorizing them. Once you have a clear understanding of where your money is going, create a budget that aligns with your financial goals and stick to it.

You can leverage our Money Management tool to track and understand trends in your spending.

High-interest debt typically includes credit card debt, personal loans, or payday loans. These types of debt can hinder your ability to achieve your financial goals and create a cycle of debt that’s difficult to break.

To pay down bad debt, prioritize your debts based on interest rates, and focus on paying off the debt with the highest interest rate first. As you pay off your debt, you free up more money to put toward your financial goals.

An emergency fund is a crucial component of any solid financial plan. Think of it as money set aside to cover unexpected expenses, such as a medical emergency, car repair, or job loss.

A good rule of thumb is to have at least three to six months of living expenses saved in your emergency fund. Building your emergency fund can be a hard step, but it’s essential for your financial security.

Once you’ve built a solid financial foundation, it’s time to start investing. Investing is a powerful tool for growing your wealth over the long term.

There are many types of investments to consider, including stocks, bonds, mutual funds, and real estate. It’s important to do your research and consult with a financial advisor to determine the best investment strategy for your goals.

Increasing your income streams is a powerful way to accelerate getting to your goals. You can do this by developing new skills or starting a side hustle.

By increasing your income streams, you’ll have more money to put towards your financial goals and build your wealth more quickly.

Check out our secrets of a side hustle to learn more! For our entrepreneurs who want to #BuildBlack, check out the ways in which you can move the dream forward by building up the new #BlackWallStreet.

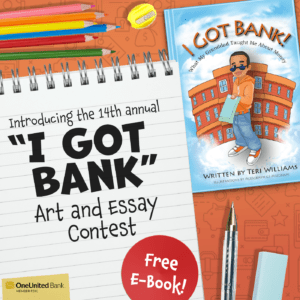

As you accumulate wealth, it’s important to give back to your community and those who have helped build you up. You can do this by donating to charity, volunteering your time, or starting a philanthropic foundation.

Remember that building wealth is a journey, and it’s important to celebrate your accomplishments along the way with friends and loved ones!

With intention and a plan, you too can hit the 7 money milestones and build #GenerationalWealth!