Summary

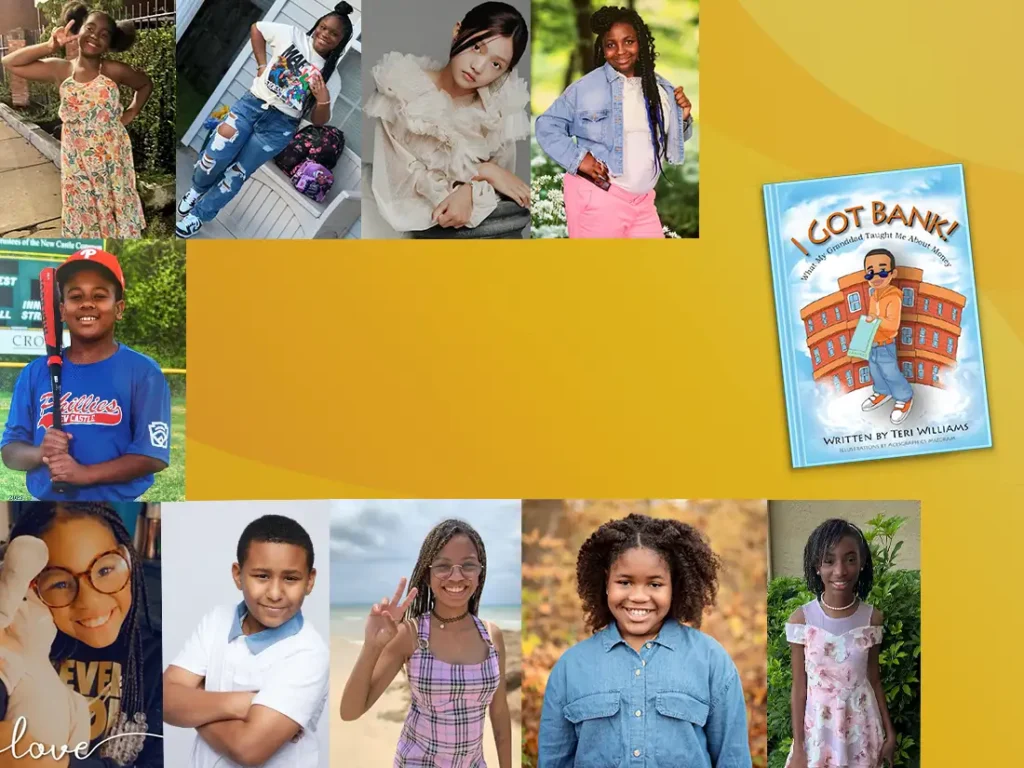

Meet the winners of the 2023 I Got Bank Contest! Explore their entries below and follow their path to securing a $1,000 savings account through our financial literacy competition. Your child has the chance to win $1,000 too, simply by joining our 14th annual I Got Bank Contest during National Financial Literacy Month. Take advantage of our free resources and encourage your child to participate in the 2024 contest today!

Meet our 2023 I Got Bank Winners who won a $1,000 savings account! Check out their art and essays. We’re proud of them and their families for supporting their participation in our financial literacy art and essay contest for youth.

Your child can win $1,000 too!

In celebration of National Financial Literacy Month, we just launched our 14th annual I Got Bank Contest. Click HERE today to get our FREE Black Panther electronic comic book, download our FREE I Got Bank eBook and have your child enter the 2024 I Got Bank contest. See details.

Zoey Bradley, 9, Columbia, MD

Money is a powerful thing. You can use it in good and bad ways. Learning all about it is a good thing to do at a young age. They don’t teach a lot about it at school so learning earlier is a better thing to do. Reading books and discussing money with your family is a good way to get smarter about money.

Making money is a hard thing to do. You might be pretty young and can’t get a paycheck yet, but you can still make money. To make money you can do things like start a jewelry business or even just clean up the neighbor’s yard just to get a little bit of money. Kids have to be creative because we can’t get an official job.

Spending money is another thing, it is important to think about what you need to spend it on.

Maybe you need new clothes and a new hairbrush. Spend money on things that last longer than things that go quickly. Not like if you got candy that will not even last a week. You should think about what you spend your money on because it is hard to make.

You might not think it but you can have emotions about money. When buying you might feel guilty, greedy, anxious, or jealous about money. Something you can do about your feelings about money is to follow a few steps 1. Do you really need it? 2. Is it a need or a want? Thinking about this can reduce your stress and bad feelings about money.

Money is something that you can’t easily get back so be careful on what you spend it on. Make sure that you understand prices and how to use money. Young people should talk to adults about how to use money in good ways. Money is something that you need to understand for the rest of your life.

Jada Current, 12, Buckeye, AZ

Why Finance is Important and Helps in the Future

In the book “I Got Bank,” I learned more about finances. I learned the importance of saving money, maintaining a good credit score, and the traps of payday loans, as well as understanding how money works. All this is the key to financial success. Saving money at a young age is beneficial because it forms a good habit of paying yourself first, like my mother always says. It creates a habit of being disciplined and developing goals to reach your dreams.

In the book “How money works for Kids” it talked about the value of compound interest and how the rule of 72 could work in my favor if I invest my money properly to become financially independent at a younger age than my parents.

It’s important to save what you have in case of emergencies. Save half, spend half, but don’t ever spend what you don’t have is a wealthy person’s way of thinking. In my household, my papa and parents are constantly talking about making your money work for you, so you don’t have to work for it forever and to live off the interest of your money.

I want to go to college someday, so saving is a big deal for me. I am the fourth of five girls in my family, and I want to be able to help my parents as much as possible with cost. I know the younger I start, the better, which is why I put my money away now in savings.

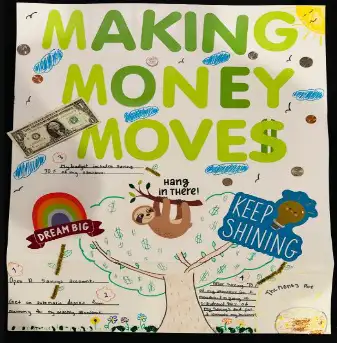

Kailee Marie Friend, 8, Hawthorne, CA

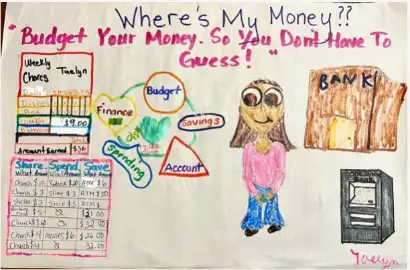

Taelyn Johnson, 9, Dorchester, MA

Sue Lee, 12, Los Angeles, CA

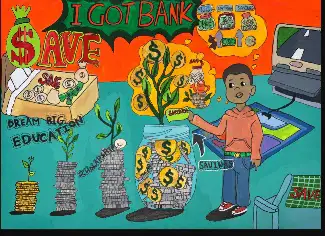

Ian Robinson Jr., 11, Middletown, DE

Hello,

My name is lan Robinson Jr. When I grow up, I want to be a professional baseball player and since professional sports players make a lot of money, they must be smart financially.

“I Got Bank” taught me to only spend money on things you really need. Things I really need are food, water and a house.

I also learned that a deposit is when you put money in the bank and a withdrawal is when you take money out. I learned that it’s more important to put money in the bank than to take it out. If there is an emergency where someone in my family was in the hospital and I had to pay their bill, I could if I had money saved.

Another thing I learned is that if you don’t pay for your car every month a tow truck will take your car. If your car is taken, you won’t be able to do important things you need to do like go to work and get back home if you go somewhere.

Now that I have read “I Got Bank” I will focus on investing my money and saving by only spending money on things that I really need. When I was younger in the past my family would give me money and I would spend it whenever I could but now that “I Got Bank” taught me finance I have learned that it’s important that you save and invest your money instead of spending it as soon as you get it. It has taught me to manage my money even as a rich sports player.

Cailyn Sanders, 11, Miami Lakes, FL

My dad always told me “Save your money when you get it”. This book taught me how to do just that. I know that saving isn’t only about gaining money for big purchases but using that money when it’s appropriate.

Jasmine got a loan when she was 15 years old, however no one under 18 can take out a loan. Jackson’s check bounced, or went back to the bank, because he didn’t have enough money to cash the check. I learned to be careful when taking out loans and cashing checks!

Before reading this book, I didn’t exactly know what a banker is. I knew bankers manage people’s money, but I couldn’t think of anything else. Miss Benjamin taught me that bankers are recyclers because they take money people save and turn it into loans for other people. I can use this knowledge if I get a loan, so I know why it’s so important to pay it back.

Finally, I learned about profit. Profit is the difference between the revenue and outgoing cashflow, or simply cash flow. I make a profit from my chores. However, businesses probably won’t make steady profits without the 4 Ps: product, price, promotion, and place. The 4 Ps will help a business thrive and survive!

I learned 6 important pieces of information from this book. I learned about helpful vocabulary and phrases, loans, checks, a banker’s job, profit, and the 4 Ps. These 6 things will all help me fly high in my financial future!

Aydin M. Soner, 9, Columbia, SC

Katalyn Wiley, 11, Conway, AR

Reading “I Got Bank” taught me how to bank responsibly, when and where to spend my money, and the laws of banking. I should remember to bank responsibly as I reach adulthood, but I can start now. Money should mostly be spent on what I need, not always on what I want. I should watch how I spend my money.

I learned that I have to control when and where I spend my money. I tend to buy things I don’t need and waste my money. For example, I saved some of my allowances for my summer trip to the National Beta Convention. I focused on spending responsibly.

I would love to help my family with the bills and I can help by giving up a percentage of my allowance. I always have someone like Miss Benjamin to tell me I don’t need everything. That person in my life is my mother.

The laws of banking are vital. If I want to have a good credit score then I can be successful. For me, I need to learn these things if I want to become an entrepreneur. I shouldn’t buy nonessential things if I don’t have enough money. I will avoid payday loans. As I get older, I hope to open a Certificate of Deposit and use the interest to invest in the homeless shelter I want to build in the future. I have to be wise in spending my money, focus on my needs, and become familiar with the laws of banking.

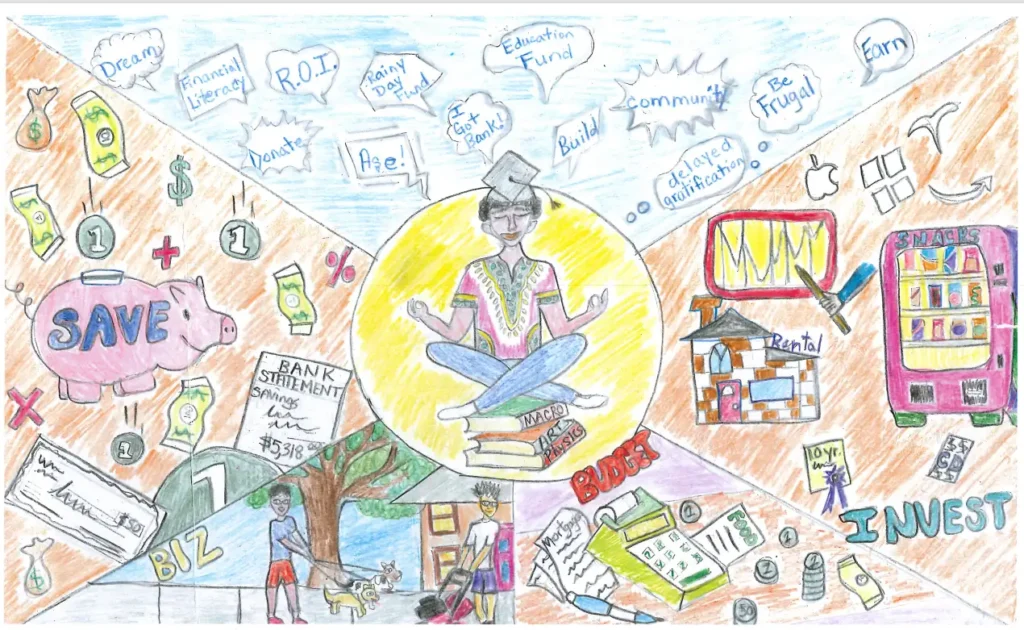

Tatyana Wright, 12, Columbia, SC