Two of a three part series.

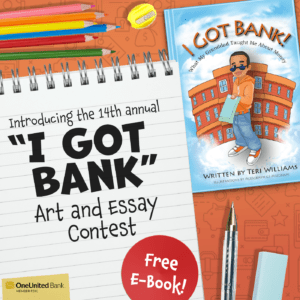

OneUnited Bank announced its I Got Bank 2nd annual Essay Contest winners on August 9, 2012. The contest is designed to promote financial literacy for youth (ages 8 – 12). The winning essays are fabulous. We think you will agree.

Here is one of the three winning essays:

Stephanie. Orellana

Compton, CA

Age 12

My name is Stephanie Orellana and I’m 12 years old. I live in Compton, California and I am entering the 7th grade at Williowbrook Middle School. I got the idea of entering the “I Got Bank!” contest because I was interested to learn more about banking and how saving money would be useful for my future plans to go to college.

I read the book and it was very interesting and it also made me think ahead about how to pay for college. When I grow up I would like to have a chance to have a career and go to college. This book made me think how hard it will be financial wise once I am accepted.

I am aware how much our nation’s economy has struck many families very hard. What I learned from the book by Teri Williams was that it’s good to start early and be smart with how you handle your money. It also made me think about the many ways you can be ready and it’s also better to seek help and advice from experts. That’s exactly what I did when I decided to find out what others thought and handle their personal business. I was encouraged to find out and exactly see what people do with their money.

I had to look elsewhere since I don’t have any money, even though I help my mother with her business. My parents do not give me an allowance and they have been talking about helping since I started this paper.

I asked around and one of my teachers who used to work in banking and finance asked me to put together a list of questions to find out what my friends, family, and neighbors in Compton are doing with their money. It took me a week to finalize the survey and another week to interview 50 Latinos who live in Compton. The survey of 50 persons ranged in age from seven up to fifty-five years old. It took about five to seven minutes each. I actually learned a lot as the results impressed me.

I interviewed seven kids, eight teens, and thirty-five adults. In all, twenty-seven persons did not have a bank account at all. Only three had a business, twenty-eight rent where they live and ten live with their parents, and eight own their own homes.

I asked only the people that have accounts “At what age did you start saving? And what made you start saving?” 15 people replied with Bank of America, some said because it was the closest one to where they work or near their home. Others said because parents or relatives recommended. Four people started off with Chase because when they started Chase was the most advertised bank and you could find it anywhere.

I also asked “what was the source of your savings (allowance, job, gifts, inheritance, etc.)?”and the most people said because they got their first job and others mostly picked allowance. With the advantage I asked “Do you mind sharing how much you have saved so far?” A grand amount didn’t want to say because they don’t have a lot. I saw with the ones that did answer, as well didn’t have much, mostly around a thousand.

Out of all 50 people I only asked twenty-three persons, known as the ones that have accounts, these following questions “Do you have a goal or plans or a savings account? How many banks accounts do you have? Are you aware of your current interest rate on your savings account? Have you changed banks before? Do you trust your bank, please explain?”

Five people don’t have goals or plans for their money. Six out of the eighteen want to buy their own house. The rest listed something like; a business, a car, for an emergency, a vacation, or for their children’s future. Fifteen out of twenty-three people have both savings and checking. Five only have checking, and three only have savings. Only nine people are aware of their current interest rate. As well as the rest of the eleven persons don’t know or are not sure.

Out of twenty-three only sixteen have not changed banks. The other seven have changed less than three times. Only four persons I interviewed, started with Bank of America and the most known banks, like Chase or Wells Fargo. Two persons caught my eye the most. The first started off with Wells Fargo and changed to Chase. I asked them, “Why did you change to Chase?” They replied “because a lot of people I know are in Chase and it’s the most advertised bank you saw at that time.” The second one started with community banks and changed to Bank of America. I also asked as well “Why did you choose to change bank?” They responded “when I opened an account I lived near the community bank but I moved and it was too far. So I moved to the closest bank where I live now and that is Bank of America.”

The last question I asked people that have accounts was “Do you trust your bank, please explain?” Nineteen of the people said yes. Some of the reasons they gave were; I know my money is there when I need it, I have no problems, it’s the first bank I have ever had, and a lot of close friends have it as well.” The rest of them were four in total and they didn’t trust their banks. One of the reasons was that they took their money. Another said because they don’t want to be with a stress of banks.

With the people that don’t have banks accounts I asked “Why don’t you have an account? What prevents you from opening an account?” A lot of results were different but the most five spoken were, “I don’t trust banks, economy wise, no social security number, I think I’m too young, and I never thought about it.” I also asked “If you don’t save your money in the bank where do you put it (investments, loans to others, etc.)?” I was surprised because almost all of the people answered alike. The two most common replies were “I’m not employed and/or working so I have no money to save and I keep it in my house.”

(*This essay received minor edits for clarity for the reader.)