One of a three part series.

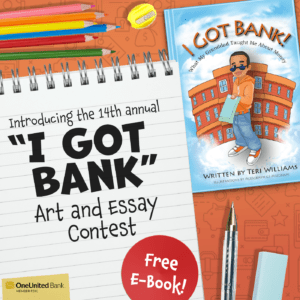

OneUnited Bank announced its I Got Bank 3rd Annual Essay Contest winners on August 7, 2013. The contest is designed to promote financial literacy for youth (ages 8 – 12). The winning essays are fabulous. We think you will agree.

Here is one of the three winning essays:

Milana Margetson

Medford Massachusetts

Age 12

Did you ever wonder the do’s and don’ts of banking? Well it is your lucky day. In this presentation you will find out about financial literacy (that means understanding money).

If you are 10, 11, or 12 like me, just save your allowances each week. Maybe you get $5.00 because you are 5 years old. Try to save it all, or most of the money fast, no matter what. DON’T TAKE OUT ANYTHING!!! If you need money fast try talking to your parents, or do some extra chores around the house to earn some money.

Next on how to save your money is, DON’T go to quick check cashers! They kind of steal your money. Let’s say you borrow $600.00. When you’re done paying them back it will be like you are paying $800.00 back or more. They make it easy because they only ask you to pay back a little at a time. That money can be saved in the bank for college or for the future. The repo man will come and take the car you bought if you can’t finish the payments.

Our next item on the agenda on trying to save money is collateral. If you make a loan from the bank and put up your house for collateral and don’t pay the loan, they kick you out of your house and sell your house to get the money back.

F.Y.I. you shouldn’t really spend your money on things you really don’t need. It’s ok to buy something as a treat, but not all the time. You can donate the money to homeless shelters, or animal shelters for food, water, treats, and toys. (Donate means to give away money for a good cause because you want to).

I know that to earn some extra bucks I will work as hard as I can and will never be deceived by get rich quick schemes, Also try keeping track of your money payments and ALWAYS pay on time because if you don’t, the bank can take back whatever you bought like Nike shoes or Northface jackets. They can also bounce back your checks or tell others that you don’t pay on time.

Now a little about myself: For a sport I do track & field. I am considered a sprinter. What I like to do most is take a hike with a friend or dog. My favorite subject in school is ELA. I like ELA because I like writing about my feelings with other people. My favorite dog breeds are Labradors and Boston Terriers. If I do win the $1,000 I will donate some of the money to some animal shelters who need some extra food/water. I would also save the rest of the money for college.