When you #BankBlack, you recirculate dollars within our community, helping to build businesses, dreams, and opportunities. Here are 10 key benefits of why it pays to bank with OneUnited Bank.

You’re seconds away from opening your account with us – so close!

When you complete your application online, you’re getting more than just a bank account.

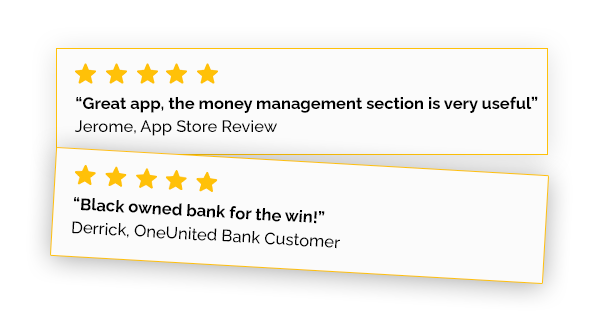

1 | #BankBlack

We are the nation’s largest Black-owned bank, responsible for sparking the #BankBlack Movement. We stand as proof that our community is resilient. We innovate and serve our community in more unique ways than any other bank. That’s the power of the BankBlack Movement. It’s by us, for us!

2 | Unapologetically Black Card Designs

We reflect our community in every fiber of our DNA. No other payment vehicle boasts the beauty of us like our BankBlack Visa Debit Cards. From kings and queens to restoring Black Wall Street, the power is undeniable.

Take pride, unapologetic pride in every purchase you make!

3 | Money Management

Nothing compares to our Swiss Army Knife approach for managing your money! Money Management allows you to easily and securely keep track of your finances. It’s an essential suite of resources in any financial tool belt.

Get an immediate overview of:

- Budgeting

- Spending trends

- Saving goals

- Multiple bank accounts

- Debt Payoff Forecasting

- Bills and more!

4 | CashPlease

Forget the payday loans! Lean on CashPlease in times of financial need. We offer a convenient way to manage unexpected turns in life, with quick and easy access to a short-term, small-dollar loan.

- Save big on interest and fees!

- Borrow up to $1,000 (subject to eligibility restrictions)

- Cash in your account within 4 hours

- Easy online application

- Check to see if you’re eligible for a loan now

5 | Rewards Suite

Consider it a treat! Our Rewards Suite is made to reward you for being a committed customer.

Tap into the power of its three components:

- BankBlack Advantage – Swipe for Swag! Earn points by simply using your OneUnited Visa Debit Card to redeem for exclusive gifts, gift cards, and merchandise.

- Purchase Rewards – Get cash back with your OneUnited Bank Visa Debit Card while doing what you already do…make purchases, including hotel stays and get rewarded!

- Referral Rewards – Use your Advocate Referral Code to get $50 for each qualified new customer up to $1,000/month. Complete activities, like setting up AutoSave, to earn points, badges, and special gifts.

6 | Early Pay

Imagine your rent is due Thursday and you get paid on Friday! This scenario for many of us leads to stress over how we can pay bills on time.

With just a few taps in our mobile app or our online banking, you can get your direct deposits up to 2 days early with Early Pay! That’s right, get paid early.

- It’s an easy setup! No extra fees or handling charges! Get your money faster when you #BankBlack.

- New to The Movement? Start by activating your BankBlack Visa Debit card!

7 | Financial Education

Our community is at a disadvantage in accessing financial best practices and advice. It’s incredibly important to gain these skills in our networks and pass them down so we can build strong financial roadmaps! Our Financial Education Center provides a simple way to get started!

From retirement preparation to getting acquainted with the basics, we have you covered. Dive in and get #FinanciallyLIT!

8 | Business Loans

Closing the racial wealth gap requires us to have access to resources to build our businesses. Our partnership with Lendistry addresses this by offering a resource for small business loans for customers to expand, buy an existing business, or finance working capital.

If you own a business or plan to buy a business, check out our small business loan resource today!

9 | UNITY Visa Secured Credit Card

Oftentimes we can face trials and tribulations with our credit. Negative hits on our credit score can start to limit our financial options. Enter our UNITY Visa Secured Credit Card, more than just a credit card, it can help you make a credit comeback!

- Rebuild and strengthen your credit over time. Secured credit cards operate similarly to debit cards with an added benefit. We handle reporting to the 3 major credit bureaus and it’s a resource for those just starting to build credit or who need to get their credit back on track.

- Access to the How to Rebuild Credit Program. Learn our tricks and tips to master the game of credit!

10 | U2 E-Checking

Get a second chance on your banking history even if you have ChexSystems records.

- Enjoy FREE services! Purchase Rewards offering merchant discounts, mobile banking, online banking, bill pay, and balance alerts; plus a free BankBlack Visa Debit card.

- Take advantage of low or no fees! Low minimum balance and account maintenance fees. Low or no transaction fees.

- Learn more!

As the nation’s largest Black owned digital bank, we strive to create solutions that will help bridge the racial wealth gap. Join us in building the next generation of Black wealth by opening your Black Wall Street Checking today!