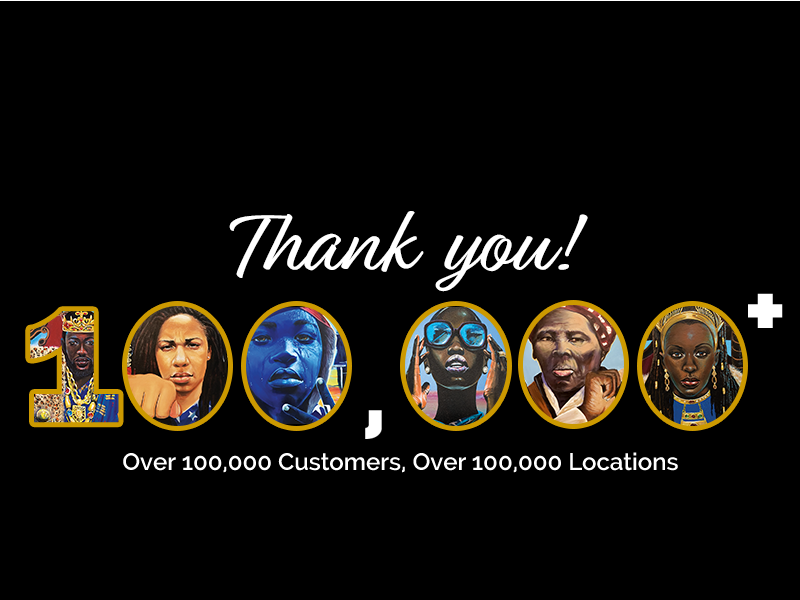

We are proud to announce, as the largest Black-owned bank in America, we have achieved two important milestones, over 100,000 customers and over 100,000 locations. Thank you!

Over 100,000 Locations

We’re proud to announce the expansion of our banking services to total over 100,000 locations. Introducing our new Cash to Your Card service, which gives you access to an additional 90,000+ locations. Through Green Dot, you can deposit cash on the go (reloading) including Reload @ the Register™, Walmart® Rapid Reload and MoneyPak®! Retail service fees and limits apply. 1 OneUnited Bank does not charge a reload fee. Our branches, 90,000 Cash to Your Card service locations, and 37,000+ surcharge-free ATMs expand our total locations to over 100,000!

Over 100,000 Customers

Our customers have swelled to over 100,000 accounts – an important milestone and just the beginning of our journey. This milestone has not been achieved by a Black bank since Maggie Lena Walker, the first Black woman and first woman bank president in the United States, founded St. Luke Penny Savings Bank in Richmond, Va., in 1903.

In 2016 due to the spate of murders of Black men, rapper and activist Killer Mike urged Black America to move their money to a Black-owned bank, spawning the #BankBlack movement. After the 2020 murder of George Floyd and the increased support for #BlackLivesMatter and BankBlack, Black banks saw another surge. Tens of thousands heard the call to #BankBlack as a form of activism and were drawn to our unapologetically Black message, bringing us to over 100,000 accounts and continuing our leadership as the largest Black-owned bank, focusing on closing the racial wealth gap and creating generational wealth.

As the largest Black-owned bank in America, we will continue to expand our customers and our locations to fulfill Black America’s long-held dream of having a national bank. We must play a leadership role to ensure local communities across the country can conveniently use their purchasing power to fight for social justice.

Again, thank you!

1 Active card required. The retail service fee for Reload @ The Register is $4.95. The retail service fee for Walmart Rapid Reload is $3.74. The retail service fee for MoneyPak is $5.95. Deposit and balance limits apply. OneUnited Bank does not charge a reload fee.

©2020 Green Dot Corporation. Green Dot, Reload @ the Register, and MoneyPak are registered trademarks of Green Dot Corporation.