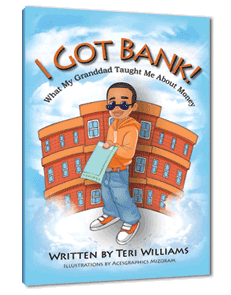

One of a three part series.

OneUnited Bank announced its I Got Bank Essay Contest winners on August 31, 2011. The contest was designed to promote financial literacy for youth (ages 8 – 12). All the essays submitted were fabulous. We think you will agree.

Here is one of the three winning essays:

What I Learned from “I Got Bank!”

by Nailah Pierce (age 12)

It is important that children learn how to use money wisely at a young age because if they do not, they could make a financial mistake that could cause problems for the rest of their life. From my reading, I learned the following things: Be careful about sharing money; advertisements can trick you; keep track of payments; banks keep track of how you pay your bills; avoid check cashers and payday loan lenders; and wants and needs are different. Here’s how I plan to use all that I learned in my life.

Be careful about sharing money with friends and family because they may spend it badly. If you do give away money, explain how to use it wisely. Someone who continually asks for money is in financial trouble or not using the money wisely. It is OK to help someone who needs the money who can be trusted to spend it wisely. I will only give money to friends and family if I know I can trust them to use it wisely.

Advertisements can trick you with get rich quick schemes that do not really work. The truth is you have to work hard for your money whether the task is as small as taking out the trash, or as large as becoming a lawyer. I now know I need to work hard and I will not be deceived by get rich quick schemes.

Always keep track of money payments and pay on time because if you do not, the bank can take back whatever you bought, bounce back your checks, or tell others that you do not pay on time. Banks keep track of who does not pay. If you do not pay your monthly payments, your credit score will get too low and you will not be able to get a loan. I will keep up with my monthly payments when I am an adult.

Check cashing businesses charge high fees for the same services the bank does for less. A payday loan is when you borrow money at a very high interest rate until the next time you get paid using your check as collateral. It is best to steer clear of check cashing businesses and payday loan lenders. If you get a loan, make sure you can pay it back and that you know all the facts about the loan and the lender.

Wants and needs are two things that we often get confused. WANTS are things that you do not need. NEEDS are things that are necessities but you do not always want. Just because something looks great does not mean you should buy it because you might need that money later. I will not confuse wants and needs.

The biggest thing I learned from this book is that there is a lot to learn about money. I will always try my best to use my new money knowledge and not make mistakes as I grow up.