Financial Goals, Recommitted: Mid-Year Checklist

A lot can shift in six months, including job changes, surprise expenses, rising prices, or just plain life! That’s why the summer months are the

IMPORTANT NOTICE: OneUnited Bank is providing these links to websites as a customer service. OneUnited Bank is not responsible for the content available at these third party sites. The Bank's privacy policy does not apply to linked websites. Please consult the privacy disclosures on each third party website for further information.

Spend 5 min, Start Building Wealth

Accounts

For Businesses

Your Financial Future, Your Choice

Financial Wellness & Freedom

Articles on credit, financial wellness, digital banking, financial literacy and social justice.

A lot can shift in six months, including job changes, surprise expenses, rising prices, or just plain life! That’s why the summer months are the

The way we work is changing—and not just for workers, but for businesses too. More companies are shifting away from long-term hires toward project-based work.

Dear Future Us, It’s Juneteenth, 2025. This year, we embrace the promise of legacy and the incredible journey that began with freedom declared. Fifty years

Summer is the perfect season to earn extra income, save more, or simply create more breathing room in your budget. Between going out, travel plans,

Studies show that two powerful factors help us reach our goals: discipline and social support. In fact, individuals who commit to a goal with someone

By observing how our kids use money, we can see the importance of financial literacy at work. Do they spend their allowance on the newest

Still feel bad about spending money on yourself even after you’ve budgeted and paid your bills on time? Drop the guilt by prioritizing your

If you’re living paycheck to paycheck while still outside living your best life… you’re likely overspending. This guide is about the actions, strategies, and mindsets

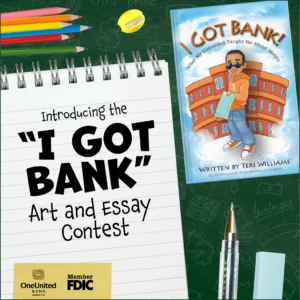

OneUnited Bank is sponsoring the 14th annual financial literacy contest for youth between the ages of 8 – 12 years old. Simply either write and submit a 250-word essay (250 words not 250 characters) or create and submit an art project (PDF only) about what you learned from the book “I Got Bank!” (or from another financial literacy book available in your library or home) and how you can use what you learned in your life or the life of your family.

Elevate your finances with insights, because we all need answers. Sign up today!

See exactly where you’re spending money and how you can improve. It’s Essential!

Accounts

Essentials

Elevate Finances

For Businesses