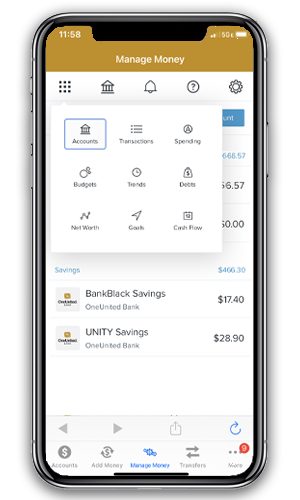

Introducing our free, state-of-the-art Money Management tool to help you reach your goals by developing a plan to take action!

Many of our customers use Money Management because they need more than a spending account, bank account or a debit or credit card, even with rewards. If you want control over your money, you need to track it.

You’re seconds away from opening your account with us – so close!

When you complete your application online, you’re getting more than just a bank account.

Our Money Management tool is FREE in our app and online banking. It provides you with a one-stop location to manage your finances easily and securely.

- Manage multiple bank accounts

- Easily track your spending and identify trends

- Set and maintain your budget

- Manage your bills

- Set and track saving and spending goals

- Check your debt payoff forecasting

Money Management automatically categorizes all your transactions and immediately lets you know when and how you spent your money to keep you multiple steps ahead!

As the largest Black owned bank and the first digital Black owned bank in America, we are focused on ensuring you create generational wealth by providing tools to improve the management of your money.

We encourage you to focus on OneTransaction that will allow you to build wealth for future generations such as savings & investments, a profitable business, home ownership or an improved credit score. With Money Management, you can build positive habits and better track your progress towards building generational wealth.

Let’s get our financial house in order to #BuildBlack, close the #RaciaWealthGap, and complete our #OneTransaction. One step at a time!