All over the news and in social media there has been talk about a bank account closure. Some have asked, “How can that happen?” As the nation’s largest Black owned bank, we would like to assure you that closing a bank account is rare. Here’s some information that you should know.

- Banks have disclosures. Bank account disclosures explain the terms and conditions of your deposit account. It’s your agreement with your bank. These disclosures include a Truth In Savings disclosure, which covers interest rates, fees, ways to avoid fees, etc., and a deposit account agreement, which covers other areas including when funds will be available (Funds Availability), how errors are resolved (Error Resolution), privacy, etc. There may be other disclosures on specific products and services like AutoSave (keep the change program). Make sure to read your bank’s disclosures.

- Banks seek to retain customers. Since attracting new customers can be difficult and expensive, most banks work to retain existing customers. OneUnited Bank offers state-of-the-art technology, rewards, great customer service and other products and services to meet the needs of our customers. We even have a Customer Success team to assist you.

- Banks are regulated. The Federal Deposit Insurance Corporation (FDIC) and state banking authorities or the Office of the Comptroller of the Currency (OCC) ensure that banks are managed in a safe and sound manner and comply with banking regulations including consumer compliance regulations. Your bank deposits are FDIC insured up to $250,000 and there are rules and regulations that must be followed to ensure your bank account is treated fairly.

- Consumer and business accounts are handled differently. Most banking regulations cover consumer accounts to protect individuals and families from unfair and deceptive practices. Business accounts, corporate accounts, or organizations (such as nonprofits) that open a business deposit account are not covered by most consumer compliance regulations. (Business owners or signatories are expected to be more familiar with bank account agreements.)

So, why are bank accounts closed?

- In most cases, an account is closed because it’s overdrawn, or has a negative balance. We have a second chance checking account for those with a ChexSystems record.

- In some cases, an account is closed because the account activity is not consistent with banking rules or regulations. As an example, if someone deposits a fraudulent check, a bank is likely to close their account.

- In rare cases, an account is closed without an explanation. Banks typically have the right to close an account for no reason and at any time, but even then, it cannot be unfair or discriminatory. Banks usually provide advanced notice.

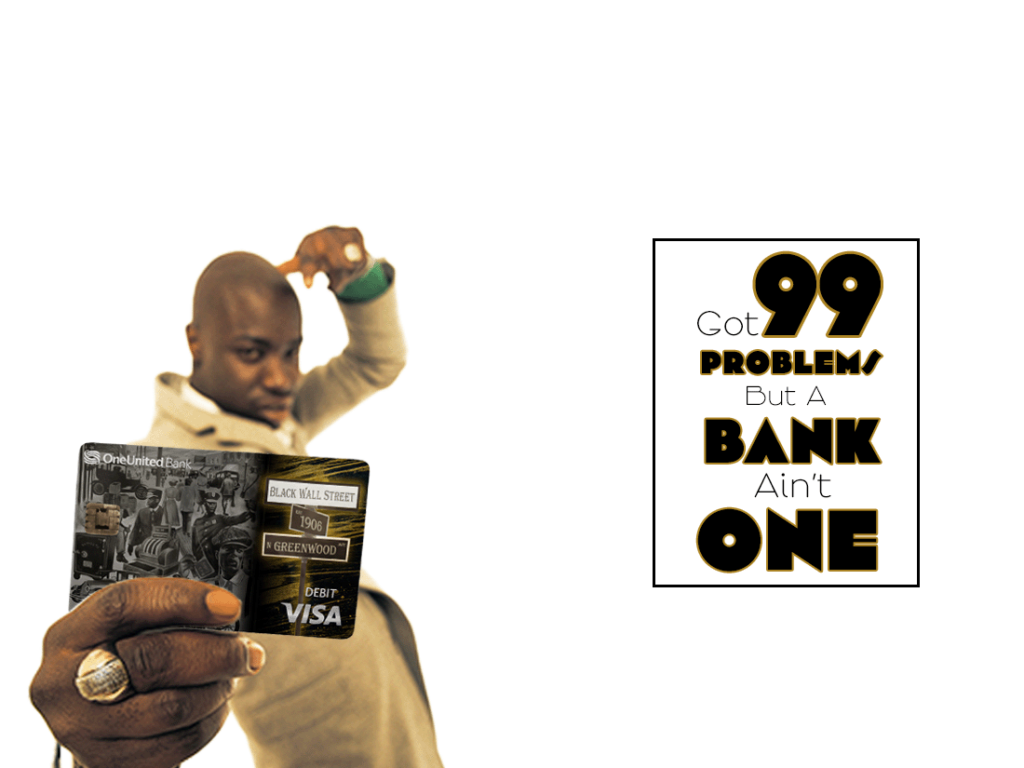

As the nation’s largest Black owned bank, we’re focused on closing the racial wealth gap. We seek to be your banking solution…and not your problem!