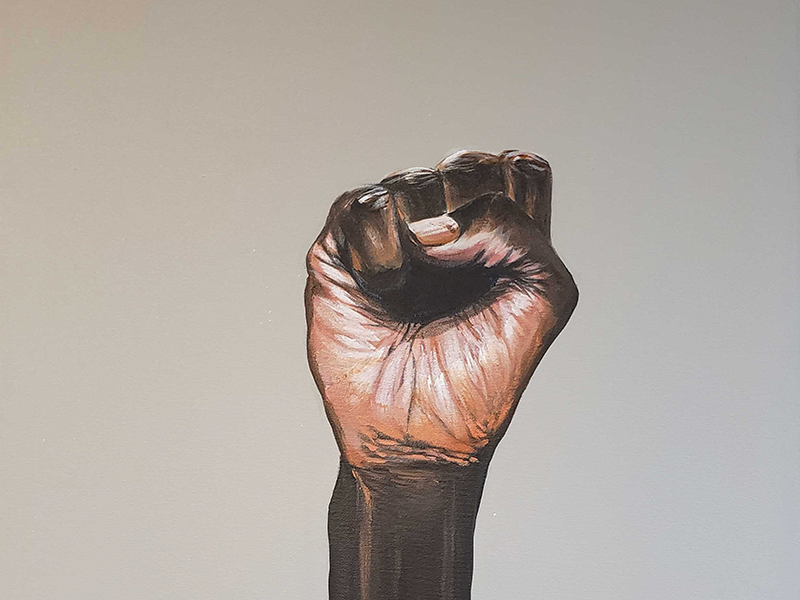

Each one of us is only #OneTransaction away from closing the racial wealth gap!

According to the New York Times #1619 Project, white Americans have seven times the wealth of black Americans on average. The median family wealth for white people is $171,000, compared with just $17,600 for black people.

Given America’s history of slavery, Jim Crow, redlining and other discriminatory practices, the racial wealth gap could be even wider, but for the perseverance of Black Americans. So rather than focus on our challenges, let’s focus on the truth and our assets. We’re only one transaction away from closing the racial wealth gap!

One Transaction

For each of us, the one transaction can vary… but our focus on that one transaction should not. Here are 6 options1 to consider:

- A Will – Ensure that your parents and love ones have wills. According to Forbes, only 28% of minorities have a will, which leaves the remaining 72% without this legal document to ensure generational wealth.

- Insurance – One of the least costly ways to create generational wealth is to have term life insurance.

- Home Ownership – The biggest difference between black and white wealth is home equity. Owning a home can create generational wealth.

- Owning a Business – Profitable business ownership can create generational wealth.

- Savings/Investments – Participating in an automatic savings plan including retirement plans can create generational wealth.

- Improving Your Credit Score – Building a good credit score gives you access to better loan programs and lower interest rates

Focus on the best transaction – the OneTransaction – for you and your family and let’s close the racial wealth gap together.

1 OneUnited Bank is not a financial advisor and recommends you discuss with your family and a financial advisor.