Introducing our 2022 “I Got Bank!” Financial Literacy Contest winners. Check out their art and essays.

Your child can win a $1,000 savings account in 2023! In addition, when they submit their art or essay, they can access a free digital version of the Black Panther Comic Book, a one-of-a-kind custom edition comic book created by Marvel Comics and Visa, Inc. that includes financial literacy exercises developed by OneUnited Bank.

Simply click HERE or visit www.oneunited.com/book! Deadline : June 30, 2023

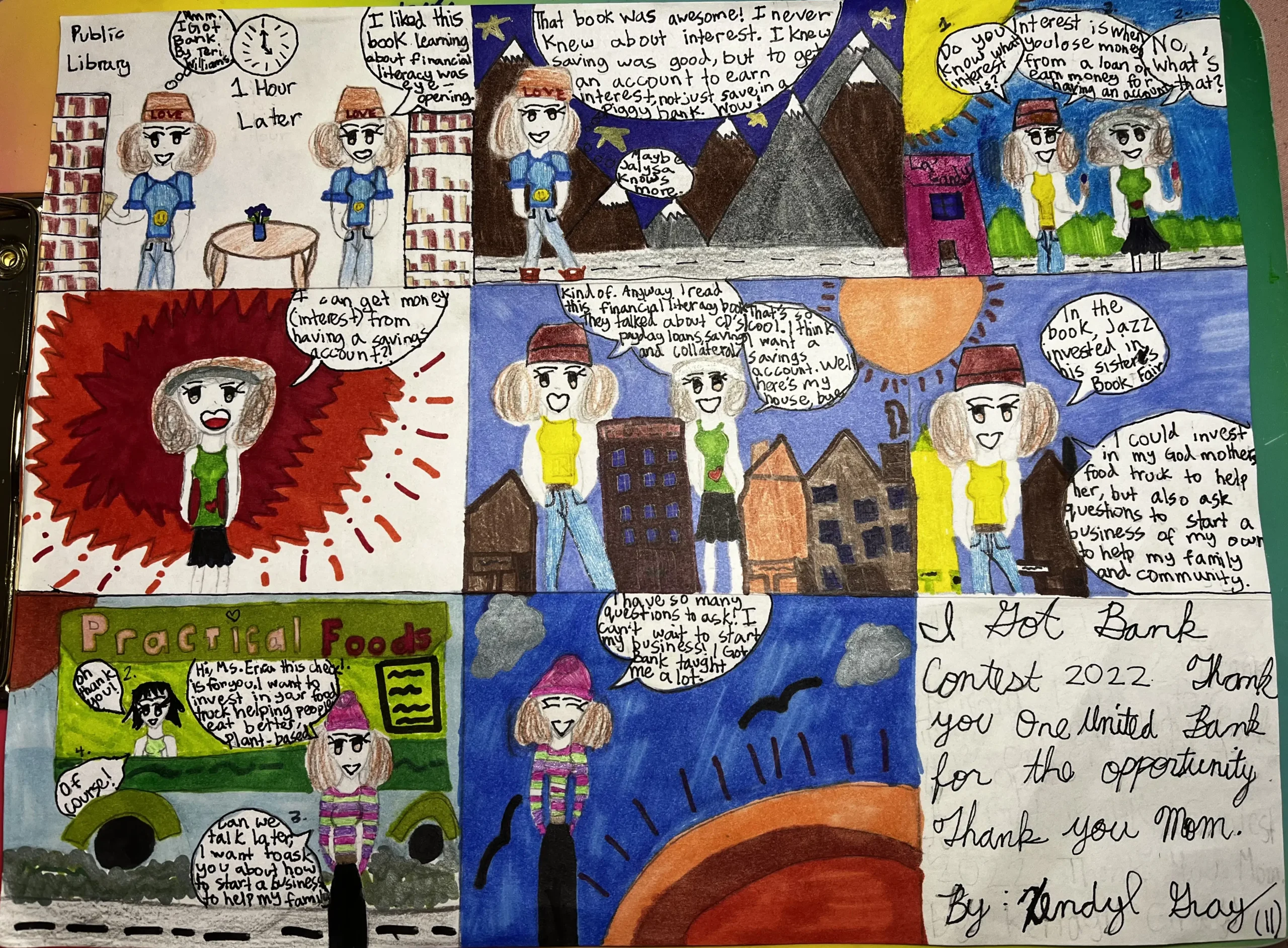

Introducing the 2022 winners: Aida Anderson, 11, Cooper City, FL, Hahrin Vivian Chiang, 9, Santa Monica, CA, Kendyl Gray, 11, Reseda, CA, Liam Hughton, 9, Los Angeles, CA, Golden Littlejohn, 8, Knoxville, TN, Grayson Nevel, 9, Boston, MA, Ryllie Stephens, 12, Sarasota, FL, Zya Taylor, 12, Decatur, GA, Kordell White, 12, Sylmar, CA, Lukas Wormack, 12, Plainfield, NJ. Each winner expressed the importance of savings.

Congratulations to our 2022 winners (in alphabetical order)!

Financial wealth is very important. As a kid, you should save your money in a bank account because it is a very safe place to store your money. By putting your money into a savings account, you have the opportunity to gain interest on the money you put in.

Another way to save your money is to invest in the stock market. The stock market allows you to buy stocks in different companies. Investing in stocks keeps you in charge of your money. Although it can be risky, you can gain money or earn dividends over time.

The I Got Bank book taught me how to be financially responsible. One way I could be financially responsible is by not spending my money on things I don’t really need. When my parents give me money or I earn it, I should save more than I spend. At least half of the money should go into a savings account or my stock portfolio.

As a kid, you should also be able to know the difference between assets and liabilities. An asset is what brings money and cash flows. A way to get an asset is to start a business. A liability is the opposite. It takes away money and stops cash flow. An example of a liability is a mortgage to buy a house. Every kid should know these useful things as it will help them become financially responsible adults.

This year for my 8th birthday, my grandma gave me $50. A few days later, my aunt asked if I wanted to sell water for $1 at her African American Market. I said yes and I made $46, which made me more interested in learning how to save money. This is when I thought of getting a savings account, because I didn’t have enough space in my wallet and the bank is very safe with money.

I can recycle money like Miss. Benjamin said in I Got Bank. I also thought of it because my parents told me that I can gain interest from the bank when I keep my money there. When I get my commission payment for doing chores, I deposit half in the bank. I had to withdraw some money because I lost a library book. I don’t want to be irresponsible like Jasmine and Jackson who didn’t pay their bills. I don’t plan to withdraw any more money because I want to get compound interest which is double interest.

With all the money I will save, I can give some to people in need, like Jasmine did with the Yancey Book Fair in the book. I like to give to the homeless and I could give to Ukraine and still have a little money for me. The little money could turn into a lot of money with interest, to save, treat myself and others. If I do these things, I can say that I Got Bank!

My name is Grayson Nevel. I live in Boston, Massachusetts. I just finished third grade. I like that Jazz saves his money in his bank account so that he can have a successful life. I also liked that Marquis is always asking questions because staying curious about everything can help you through life. I like how my mom made me read this book so I could learn about banking and saving money.

There are many lessons that I have learned from I Got Bank! The first lesson that I learned from Jasmine is that it is illegal for children to be tricked into an allowance loan. In the book Jasmine took out a bad loan from check cashers. It was a bad loan because she had to pay 4 times the amount than she took out. I also learned I have to be careful in the future with loans and look at the interest rate.

The second lesson I learned is that you should save your money and cash in your bank account. That is what Jazz did with his bank account. He saved his money so he could have a successful life when he gets old enough to leave the house. It is important when you get older you have enough money to get through life, so that’s the second lesson I learned.

This was not in the book, but my third lesson is that not a lot of people have bank accounts, so people use other risky ways to get money. I plan to save my money, so I will not have to gamble to try and make enough money. Gambling is bad because my friends or the casino will just say to play again until they win.

The final lesson I learned is that you can develop a company that gives you money like a car wash. In the book Jazz created a company that washes cars, and he is only 11! So, I believe I can open a car wash, or I could create online content as a Youtuber even though I am 9!

Reading the book “I Got Bank” opened my eyes to several important things that I did not know or understand about money. Reading the book provided me with an incentive to learn more in the future.

The single most important lesson I learned was that I should have a bank account and save money. The value of compound interest is fascinating to me. Before I read “I Got Bank”, I did not really understand the purpose or value of interest. Even though I have calculated interest in math class before, I did not realize how it could work for me. Now I understand that the option to make payments over time for large purchases like homes depends upon the payment of interest. Otherwise, no one would lend money! Still, I think earning interest is so much better than paying interest!

I admire the boy in the book who saved all his allowance for years. Realistically, I do not see myself doing that. A better plan for me is to save some and spend some. I do not currently receive much money and am talking with my parents about ways I might earn money. I will apply many points that I learned in I Got Bank. I plan to make regular deposits into my savings account and avoid making withdrawals. When my savings balance is high enough, I want to open a Certificate of Deposit. Thanks to the author, Teri Williams, and OneUnited Bank, I am off to a healthy financial start.

Have you ever received money on your birthday or for Christmas and spent it? Then you regret buying whatever you spent it on. That’s your gut saying, “you should save your money”. That’s what “I Got Bank” taught me.

Saving your money, especially at a young age, is essential. Just imagine turning 18 and going to college with a good amount of money in your savings account. “I Got Bank” showed me the importance of not spending your money on other people. There are so many people that wouldn’t even talk to you if you didn’t have money.

Growing up Black in America can make having money difficult. That’s why it’s so amazing to see people of color succeed financially. There are many Black owned businesses throughout the world that are succeeding, and I hope to be on the list of them soon.

Speaking of businesses, starting a business (or entrepreneurship) is a way to earn money. “I Got Bank” identified washing cars as an example of a job that could be lucrative. Other entrepreneurship examples included selling unwanted items, snacks, jewelry, etc.

Additionally, “I Got Bank” discussed the importance of saving. Do not spend your hard-earned money on things you don’t need. I learned that the hard way once by buying a toy that I ended up regretting. To conclude, “I Got Bank” really informed me on the importance of saving money, I will use that knowledge now and the rest of my life to work towards financial stability and healthy habits.

When I was younger, I did not know the value of money and I spent every single penny I had. As 7 years old, my mother told me the value of money and opened the door to saving. Every day I would find coins on the ground and put them in a money jar. My mom says, “pennies make dollars and every dollar adds up”. Although I did not have an allowance at the time, I would make a lot of money by selling Pokémon cards at school. Like once, I sold a single card for 20 dollars when my mom had spent almost 20 dollars buying me a whole pack. I did not have a savings account then so my money would go in a jar or I would keep my spending money inside of my wallet.

One day when I was older, my mom opened a savings account for my birthday. I would put some of my money into my savings account and keep the rest in my wallet for spending. With the money I would keep in my wallet, I would set a budget for myself. I would try to keep my budget between five to ten dollars to buy snacks and at least thirty dollars to buy toys and entertainment. My mom would put some of my gift money into the savings account just in case. She would encourage me to not spend money every time I got the chance.

When I was about 10 years old, I would find out about the “I Got Bank” challenge. I started reading the book and after that I asked my mom for an allowance. She agreed and I started making 2 dollars every day for chores. I was making money until COVID-19 started and she shut down the allowance. That didn’t stop me from savings though. I still received gift money for my birthday and Christmas. I saved 500 dollars at the time. I only spent money on things that would last a long time and things I knew I wouldn’t get bored from.

This year I signed up for the book challenge and finished reading the book. I learned that saving for what I want is important and it feels good to have extra money just because. At this point, I have finished reading “I Got Bank” and know a lot more about banks and what they do. It can be a safe place to keep a lot of money so you cannot lose money. Also, banks give people loans or borrowed money if they have collateral, or something of value. Sometimes my mom would ask to borrow money but would always give the borrowed money back. I’m still saving to this day and I am currently at $718. The “I Got Bank” book taught me that you can spend money but spend it wisely on things that you are going to be happy with and save some to keep your account growing.

Hello. My name is Lukas Wormack. I am twelve years old and live in Plainfield, New Jersey with my mom. I am honored to enter this contest and am excited to see what this turns out to become.

After reading the book I Got Bank! By Mrs. Teri Williams, I have a new perspective on money, business, and life. This book also gave me the basic knowledge on how to start a bank account, and how to not get trapped in the web of debt.

Overall, the book has been very, very helpful. When I was eight years old, my family bought me all these books about how to be a millionaire. Those books basically said the same thing you said in your book, but it was very boring. It went a little something like this: The Quintessential theory behind money making is knowing to which group of peoples you are marketing. Once you understand this critical piece of information, you can stay abreast in the cold sea that is business. Whereas, your book says the same information, but in a different manner.

I love how the information is being conveyed in a comical way. Very easy to read. I have also learned a lot from your book. For example, I learned what not to do. I should not spend money that I don’t have on silly stuff that I do not need. Jackson is a perfect example of this. Even when he did have money, he squandered it on frivolous things.

I also learned how to create a bank account and what a CD is. I have to say, although all these things are good, when I get a bank account, I am going to get a Granddad Allowance Plan (G.A.P.)

With this great knowledge I have attained, I will start a business. I will start small, and then market my product to stores like ShopRite, Costco, and Target. I very much look forward to creating my own account at the Black-owned OneUnited Bank. Maybe I will even create my own bank. Whatever the future holds, I’m in! Overall, I am very happy that I got to participate in this wonderful essay writing contest, and I look forward to what comes next!

Have a good day! – Lukas Wormack

Minor edits made to the essays.

For details, please visit www.oneunited.com/book. Also to learn about the Children’s Online Privacy Protection Act, please visit our Privacy page.