We win when your children win! Your child can win $1,000!

Introducing our 11th Annual “I Got Bank!”” Financial Literacy Contest. Your child can win $1,000 savings account at www.oneunited.com/book! Now, we’re offering a free “I Got Bank” E-Book until June 30, 2021. Today is a great time to start building generational wealth for our children! To participate, simply visit www.oneunited.com/book!

Here are four of our 2020 winners (in alphabetical order) and their essays and art: Javonte Patton, 12, Palm Coast, Florida, Alizah Perez, 12, Pembroke Pines, Florida, Sophia Prakash, 9, Glendora, California, Aarionna Totty, 9, Holly, Michigan.

Javonte Patton, 12, Palm Coast, FL

Javonte Patton, 12, Palm Coast, FL

To start off with, I will be explaining what I learned from the book “Rich Dad’s Guide to Investing” and how I will use it in my life. First, I learned a lot about investing and becoming an entrepreneur. One of the things I learned was deciding what you wanted to be when you grow up. You have to make the decision. I also learned that if you want to invest you need a plan not just the money to invest.

Next, I will explain how I will use it for my business and life. When I get older, I’m going to have my own business but before that I’m going to invest. I’m going to invest in companies such as NIKE, Publix, Supreme, etc. One reason you should invest is because you could make passive income which means you don’t have to do anything to make the money.

Lastly, I learned about becoming an entrepreneur. I’m starting to become one by buying items and candy at the store and then selling them at my school or around my block. One of the things you’ll have to face is talking in front of people you don’t know. You also need to target your community and when you want to buy something buy it from your community so you can help them out.

To sum up, I learned a lot about investing, becoming an entrepreneur and protecting your money. Time for 1,000 DOLLARS.

Alizah Perez, 12, Pembroke Pines, FL

Alizah Perez, 12, Pembroke Pines, FL

A couple of years ago, I asked my dad for an allowance. He said he could not simply give me money. He said I had to work for it. I didn’t really understand why I had to work for it, neither did I care at the time. I picked simple chores around the house and started earning money. My dad and I split the weekly allowance between save, spend, and give. Still, I didn”t understand or give any thought into it. That was until I had spent all my money.

Nothing is ever free in this world. We do not experience nor understand this phrase until we have to achieve. We must work towards it. Money is not easily obtained. Sometimes you don’t get paid enough or must use it for necessities which becomes an obstacle when wanting something.

This is where saving comes in handy. Saving can help you get closer to what you want by putting away bits of your allowance aside. Through this year, I’ve saved almost 600 dollars! Furthermore, spending money is a vital part of everyone’s life. The way we spend money affects us directly. The saying “Spend your money wisely” does not mean don’t spend your money at all. It means to think about whether what you want to purchase will really benefit you or not.

While all of this is important, giving back is above all of them. Giving money to those who need it, those who are sick, programs, organizations, etc. build a structure for our communities. If we were all to give just a little bit to all of these, we could find that our future will begin to change and bring opportunities to those who did not have it before. Just remember, “Money has a purpose”. (from I Got Bank by Teri Williams)

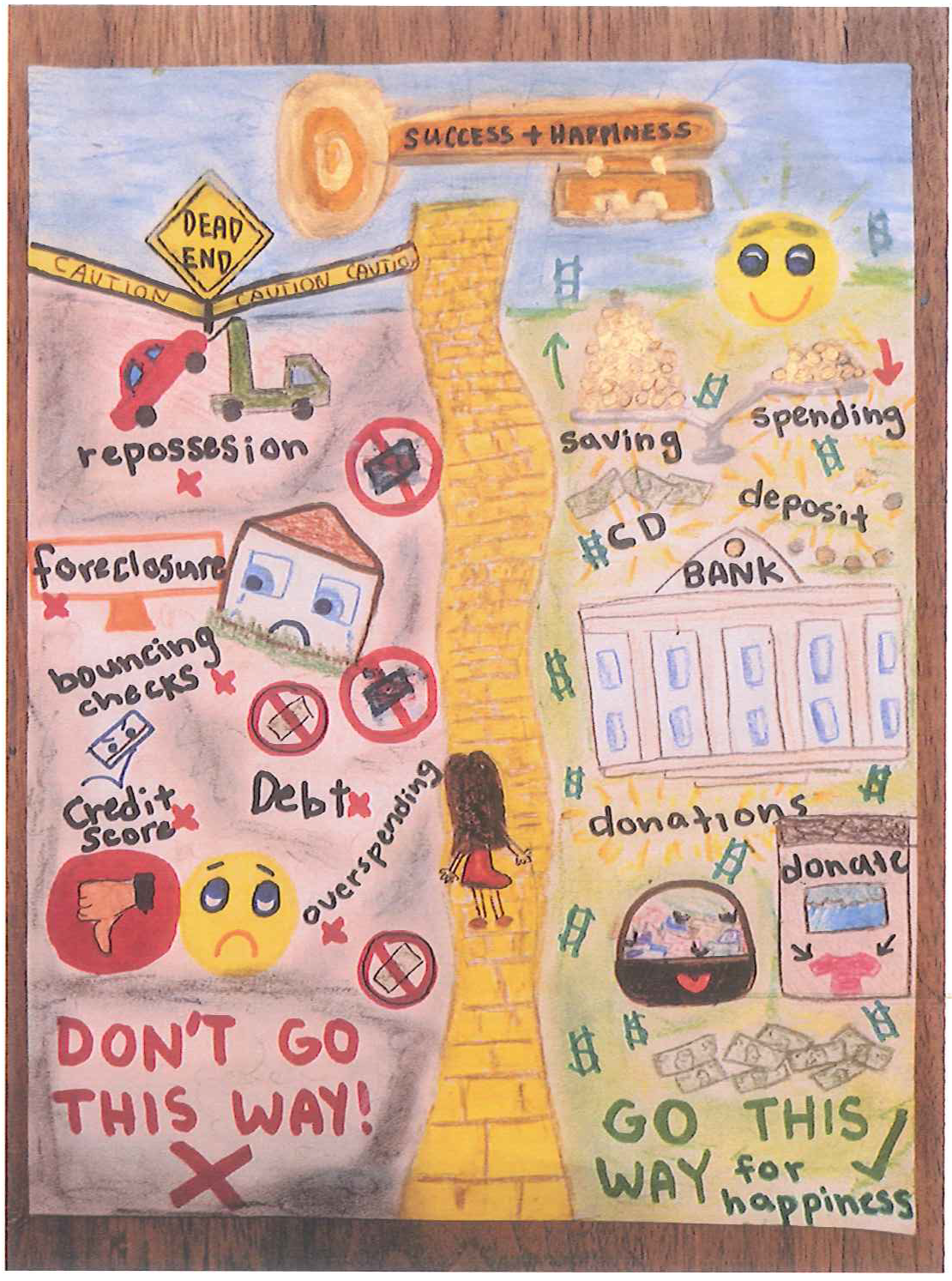

Sophia Prakash, 9, Glendora, CA

Sophia Prakash, 9, Glendora, CA

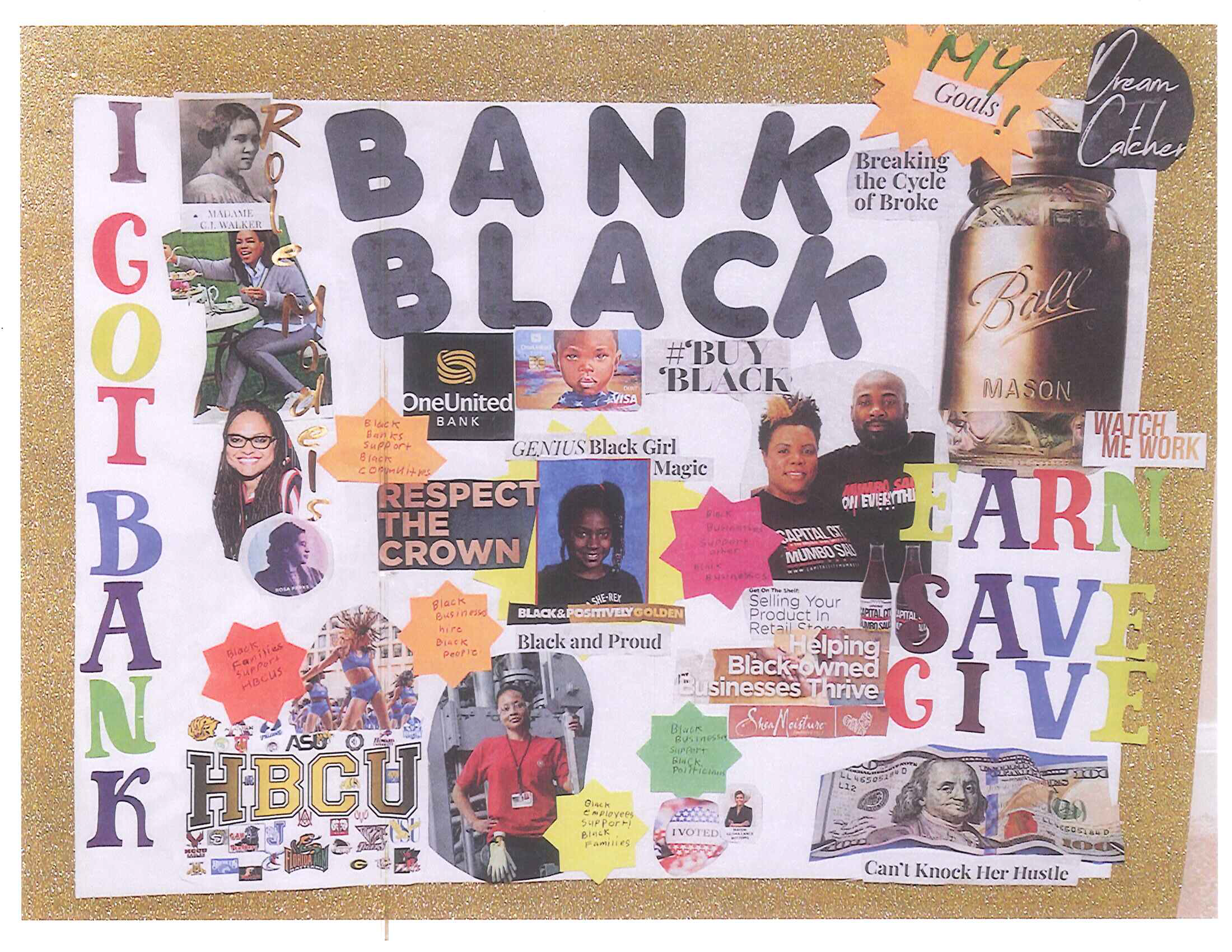

Aarionna Totty, 9, Holly, MI

Aarionna Totty, 9, Holly, MI

Minor edits made to the essays.

For details, please visit www.oneunited.com/book. Also to learn about the Children’s Online Privacy Protection Act, please visit our Privacy page.