Summary

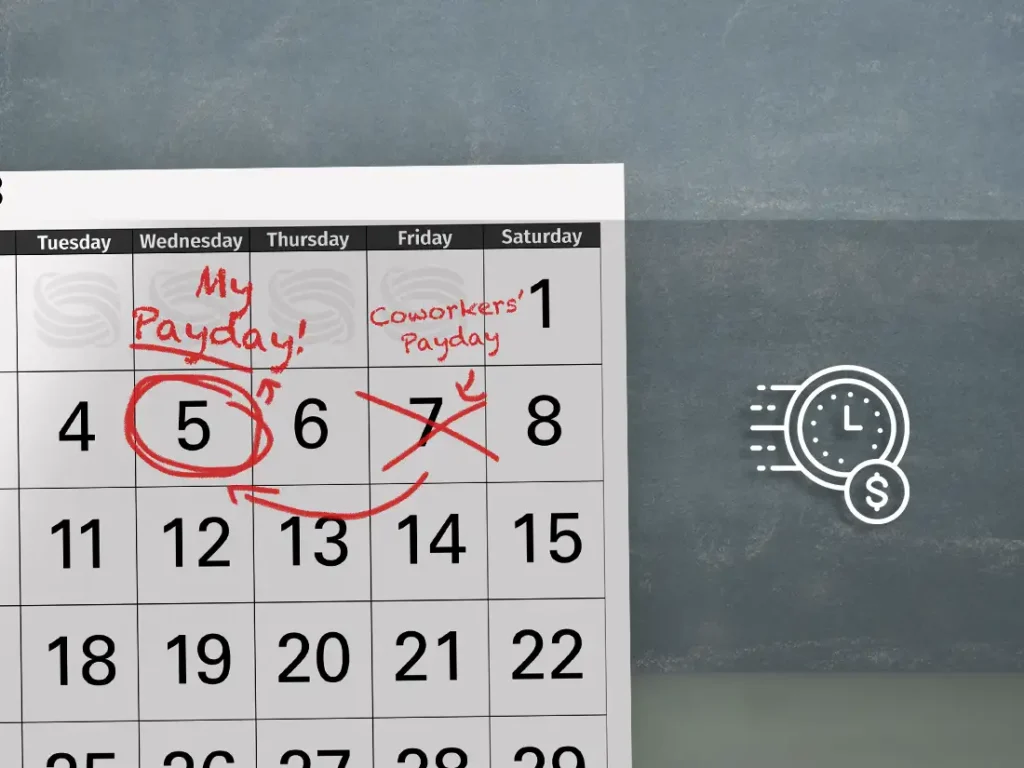

With Early Pay, get your paycheck up to 2 days earlier—no fees attached! Say goodbye to late fees and missed payments by tackling bills ahead of time. Discover how getting paid ahead of schedule isn't just about convenience; it's a game-changer for your financial well-being.

Life moves fast, and so should your paycheck. Get paid up to 2 days in advance with Early Pay. Fee free!

Late fees and missed payments are a headache. Imagine you have several bills due at various times during the month, including utilities, car payments, and school loans. With an early payday, you can strategically approach these expenses as soon as possible, before they are even due.

Per research from Filipe Correia, an assistant professor at the University of Georgia Department of Finance, people who are paid earlier in the week are more likely to save more of their paychecks. This increase in spending also positively affects savings and borrowing.

Consistent saving in your Savings Account, even in small amounts, encourages repeat saving, reduces stress, and helps you stay on track for your goals.

Stay ahead of the curve and empower yourself financially by securing your payday earlier in the week!

Set up Early Pay

Open a new account, select one of our powerful card designs like our new OneLove card, and download the OneUnited Bank Mobile app from the app store.

Log into your account, go to “Manage Your Money,” hit “2 Day Early Pay,” complete your direct deposit form and hand it over to your employer. That’s it!

You are now ready to get your paycheck up to 2 days early. Watch for the OneUnited Bank mobile app notification when your money lands in your account.

Direct deposit1 must be set up on your OneUnited Bank account for Early Pay to work.

Early Pay is for consumer non-interest-bearing checking accounts only. It takes up to 2 pay cycles before Early Pay begins.

Watch our Step-by-Step Video for More!

Access your paycheck in advance—are you game? Sign up for a non-interest-bearing debit account today and tap into the OneUnited Bank advantage.

Spend wiser. Save more. Live wealthier. #BankBlack

1Direct deposits must be made in your name or in the name of a signer on your account. OneUnited Bank pays early by making the money available as soon your verified employer/payor deposits it – which is often up to 2 days before most banks make the funds available to you.