It’s time #Kings and #Queens to teach our children how to manage their treasure!

With the 10th Annual “I Got Bank!” Financial Literacy Contest ten children will win a $1,000 savings account. To support families who are home schooling their children due to the Coronavirus pandemic, we’re offering a free “I Got Bank” E-Book until June 30, 2020. To participate, simply visit www.oneunited.com/book!

Here are four of our 2019 winners (in alphabetical order) and their essays and art: Zaiderick Hayes, 12, Birmingham, AL, Arielle Johnson, 12, Davenport, IA, DeAsia Mauldin, 11, Compton, CA, and Xavier Nelson, 12, Moseley, VA.

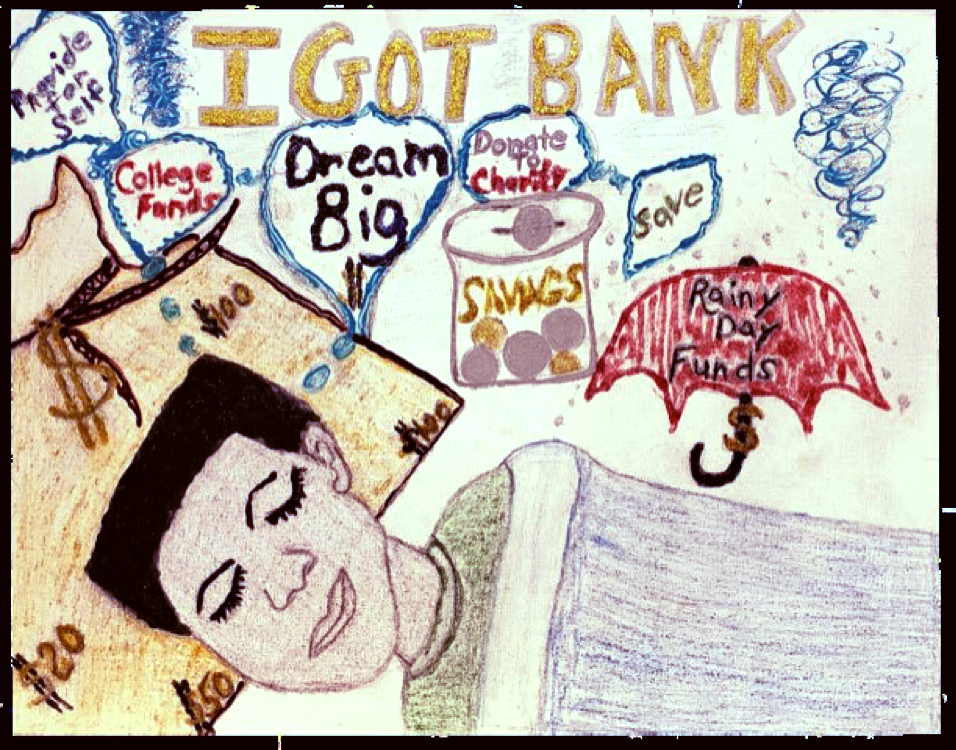

Zaiderick Hayes, 12,

of Birmingham, AL!!!

Zaiderick Hayes, 12, Birmingham, Alabama

Congratulations Arielle Johnson, 12,

of Davenport, IA!!!

Arielle Johnson, 12, Davenport, Iowa

Did you know that if you own a business that provides services, you should create a contract for every customer? I didn’t until I read A Smart Girl’s Guide to Money. This book taught me many lessons about money, including how to make it, spend it, and save it.

I learned three very important pieces of advice about money. First, know where your money is and how much you have. Second, if you start a business, be organized, calm, and smart about it. Third, only buy what you need, don’t waste money on nonsense. These lessons will help me and my family make better money decisions.

Here’s how my family and I can use what I learned from the book. We can be organized and plan everything before starting a business. Next, we will keep our money in separate accounts, one for saving and one for spending. Third, we won’t spend more money than we have. If we follow these steps my family and I will be more successful making and managing money.

In conclusion, I learned many lessons about money from this book. I learned to be organized with my money, my business, and my budget. I also now know how my family and I can use what I learned. We will plan ahead, keep spending money separate from savings, and only buy what we can afford. I would recommend the book A Smart Girl’s Guide to Money to any woman or girl that wants to learn about money.

Congratulations De-Asia Mauldin, 11,

of Compton, CA!!!

De-Asia Mauldin, 11, Compton, California

The first thing of financial guidance that was said into the book, I Got Bank, was to have an allowance as much as your age, I plan on talking to my parents about starting this type of system. Because Jazz’s account started at the age of 6, he is now ten and has $2,050.23. I also learned that if you write a check but don’t have the money for the check to be paid, the bank sends it back unpaid. This helps me because I know what could happen if I don’t keep up with my checks and my account balance.

Toward the end of the book the author talks about 2 competing businesses, “Scrub-away” and “Grandma’s Hand Car Wash”. The businesses compete using the four P’s: product, price, promotion, and place. The competition showed that one product, a machine car wash, was preferred over a hand car wash. But Jackson (the owner of the company) and his team take better care of the cars and are nicer to customers. Promotion is advertising; neither “Grandma’s Hand Car Wash” nor Scrub-Away had any commercials. The only thing Grandma’s Hand Car Wash needed to fix was price. Locals recognized Grandma’s Car Wash as the hometown wash and Scrub-away was the new cleaners coming in town.

In my opinion, this is a great example of the four “P’s”. This applies to my life because I plan on starting a business in whatever I’d like to do when I grow up and if I can stick to the four “P’s” I will have an on-point business.

With the skills that I have learned from this book, I feel that I could and will help my family and more generations to come. Especially my younger siblings, and hopefully when they get older, they will be able to read the book and win the money and will use the techniques that are used in the book to carry on with life and again teach and help other generations to come.

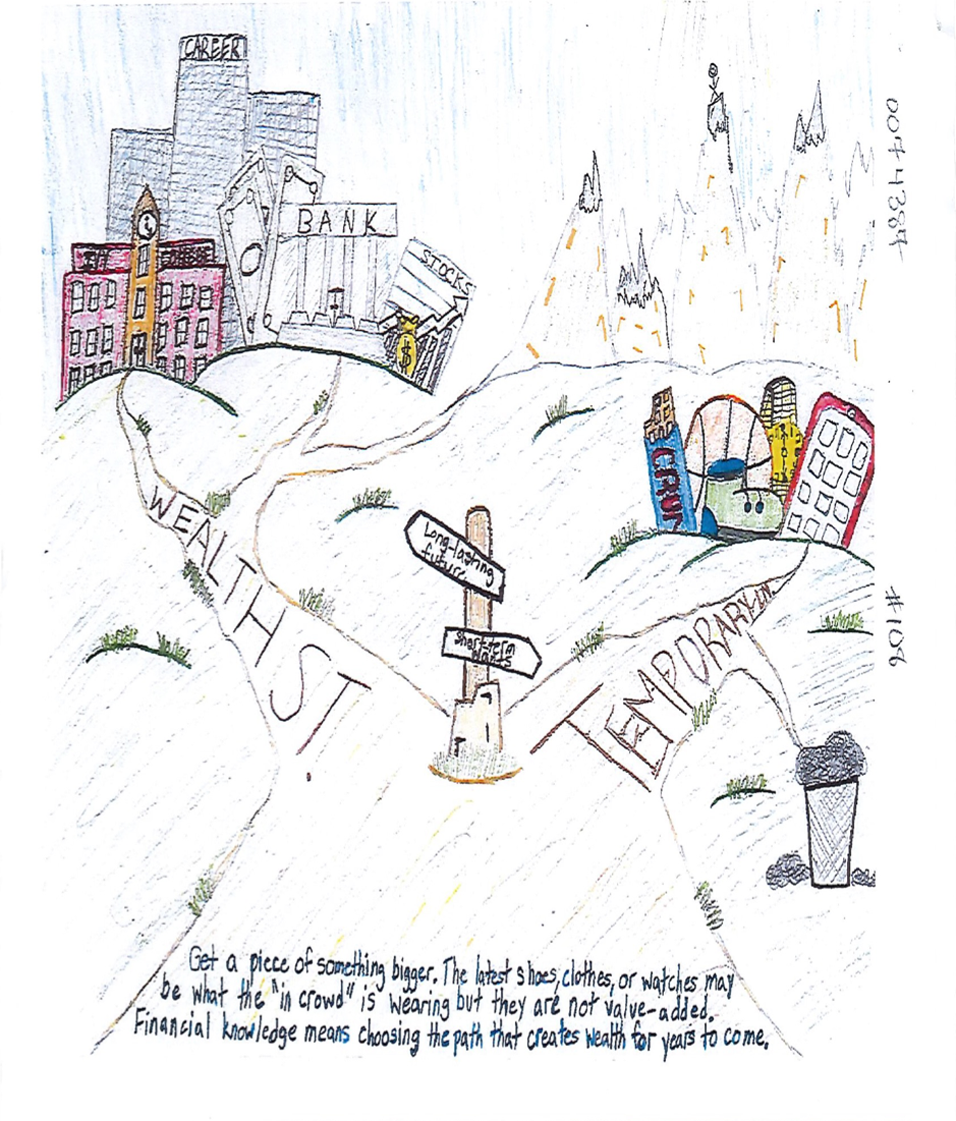

Congratulations Xavier Nelson, 12,

of Moseley, VA!!!

Xavier Nelson, 12, Moseley, Virginia

Minor edits made in the essays.

For details, please visit www.oneunited.com/book. Also to learn about the Children’s Online Privacy Protection Act, please visit our Privacy page.