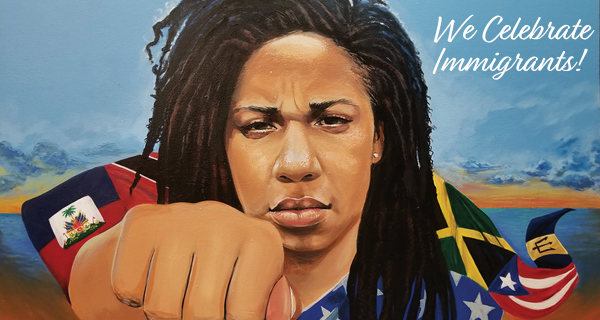

Today, we celebrate immigrants! As the largest Black-owned bank in America, we appreciate your journey and recognize your vast economic contributions to our country. And despite what we read in the press, America was always meant to be “a nation of immigrants.”

Many of us are immigrants, children of immigrants or grandchildren of immigrants. We relate to our ancestral countries – such as Jamaica, Haiti or Barbados – while also embracing America! We consider ourselves to be Black, African-American and/or Caribbean-American. Even those of us from Puerto Rico – an unincorporated U.S. territory – see ourselves as having multiple identities.

Our contributions are vast! A recent internal study by the Department of Health and Human Services found that between 2005-2014, immigrants to the United States brought in $63 billion more in government revenues than they cost the government. A 2017 paper by Evans and Fitzgerald, “The Economic and Social Outcomes of Refugees in the United States: Evidence from the ACS” found that immigrants pay $21,000 more in taxes than we receive in benefits over our first 20 years in the U.S.

Immigrants are also linked to greater invention and innovation in the US and create businesses at higher rates than native born citizens. According to a recent report by the National Foundation for American Policy, “immigrants have started more than half (44 of 87) of America’s startup companies valued at $1 billion dollars or more and are key members of management or product development teams in over 70 percent (62 of 87) of these companies.” For many immigrants, business ownership is part of our cultural DNA. As a Haitian American elected official communicated to our President & COO, “We’re used to “running things” and seeing ourselves as managing businesses and an entire country’s economy!”

So why the current negative press about immigration? Barriers to immigration come not only in legal and political form; natural and social barriers to immigration can also be very powerful. Immigrants leave everything familiar: our family, friends, support network, and culture. Immigrants also need to liquidate assets and incur the expense of moving. When we arrive in America, this is often with many uncertainties including finding work, where to live, new laws including banking, new cultural norms, language or accent issues, racism on a level not experienced in other countries, and other exclusionary behavior towards us and our family. Yet recent studies, including “Achieving the American Dream: Cultural Distance, Cultural Diversity and Economic Performance,” show that immigrants overcome cultural differences and achieve economic success over time, especially in environments that are open to diversity and ready to accept our talents.

So it’s important to have a positive and accurate counter-narrative to the current negative inaccurate press…and showcase our incredible talents!

Yes, we are here… yes, we are successful… and yes, we are America!