Money Management

Welcome to Money Management!

Say Goodbye to Being Overwhelmed by Your Finances. It’s Essential!

Let’s Get You Setup in 4 Easy Steps.

Have a question? Check out our Money Management FAQs

IMPORTANT NOTICE: OneUnited Bank is providing these links to websites as a customer service. OneUnited Bank is not responsible for the content available at these third party sites. The Bank's privacy policy does not apply to linked websites. Please consult the privacy disclosures on each third party website for further information.

Spend 5 min, Start Building Wealth

Accounts

For Businesses

Your Financial Future, Your Choice

Financial Wellness & Freedom

Money Management

Say Goodbye to Being Overwhelmed by Your Finances. It’s Essential!

Let’s Get You Setup in 4 Easy Steps.

Have a question? Check out our Money Management FAQs

As mentioned in the following media outlets:

Step-by-Step Guides

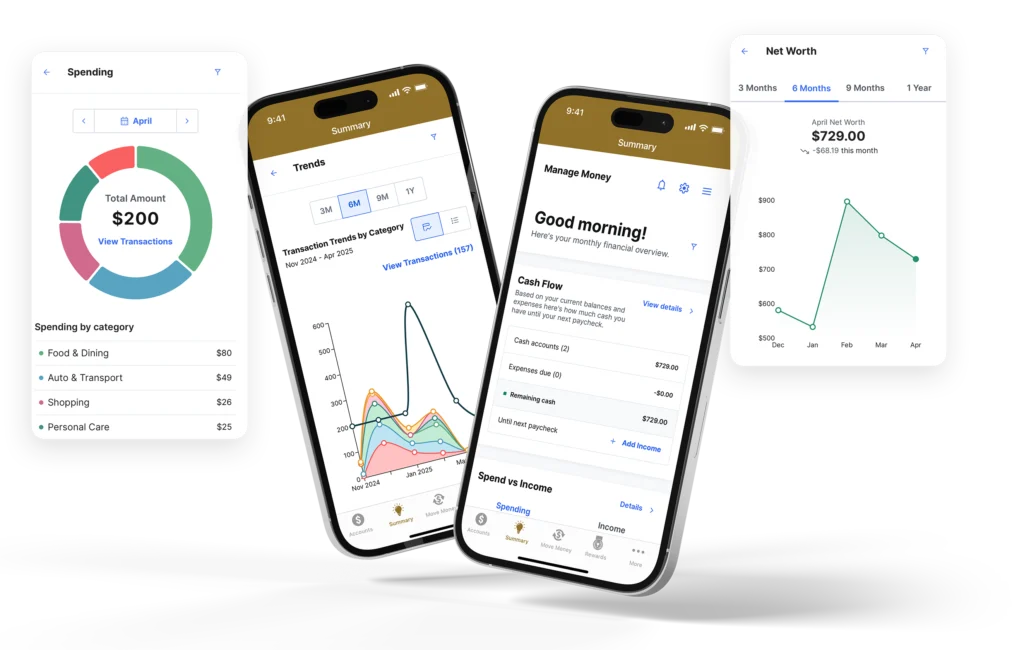

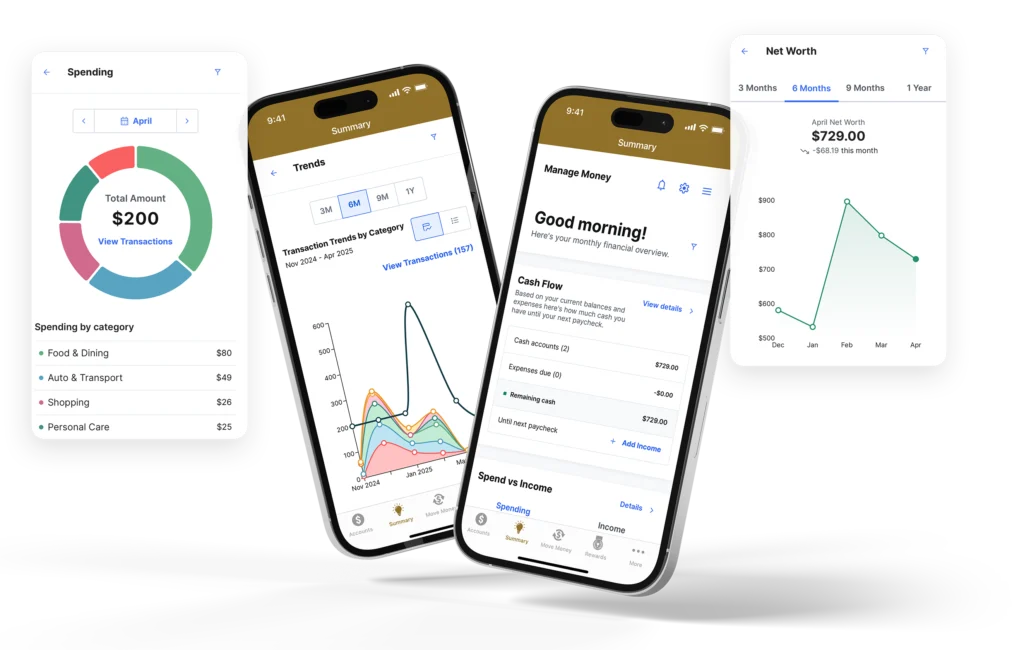

Link your accounts to see your net worth, monitor spending, and stay on track of savings and debt payoff goals.

See our How-to’s to learn more.

Your financial overview brings all your money together in one place—giving you a complete picture of your finances and the confidence to plan ahead.

See our How-to’s to learn more.

Plan smarter with a 30-day forecast of your income, expenses, and leftover cash—so you can stay on track and avoid overspending.

See our How-to’s to learn more.

See your income and spending by category—daily or over time—so you can understand your habits and take control of your finances.

See our How-to’s to learn more.

You’ve taken the first steps towards a future where every dollar works smarter for you.

Money management provides you with the ability to see all your money in one place, monitor your spending and get powerful AI-driven WiseOne™ Insights to help you achieve your financial goals.

Saving for a down payment, planning for retirement, or just aiming to optimize everyday spending? Money Management with WiseOne™ Insights can be your personal roadmap.

Get setup today by taking the 4 easy steps above!

To better manage your money by having all your financial information in one place.

To get personalized insights that inform, guide and protect your money to improve your financial wellness.

To project how much cash you’ll have between now and your next pay period.

To gain a clearer understanding of your spending habits and income.

To anticipate upcoming expenses and deposits by showing regularly scheduled transactions in one place.

To track your spending by category and monitor your financial health and progress.

Welcome! Now it’s time to connect all your accounts and start exploring the personalized insights Money Management can offer for your budgeting, credit, debt, and investments. Dive into your dashboard to see your complete financial picture and begin leveraging the AI’s power.

You’ll find our Money management app combines the best features of these apps and more. It offers personal financial recommendations, comprehensive budgeting tools, and personalized ways for you to save, all enhanced with AI-driven personalized insights and backed by OneUnited Bank’s trusted legacy. You now have an all-in-one solution.

Absolutely. Money Management employs bank-level encryption and adheres to the highest security standards to protect your personal and financial information. Your security remains our top priority.

The AI continuously analyzes your financial data to provide personalized recommendations. It identifies your spending patterns, suggests your specific savings opportunities, optimizes your debt payoff strategies, and offers insights into your investment performance, making your financial management truly tailored.

Yes! While Money Management is a product of OneUnited Bank, it was designed to help EVERYONE achieve financial wellness. You’re already experiencing the full benefits regardless of your primary banking relationship.

Accounts

Essentials

Elevate Finances

For Businesses