It’s the time of year when many high school students begin studying for the Scholastic Aptitude Test, better known as the SAT.

Many students focus on studying the information to get the right answers to improve their scores.

Some students, who are more informed about the rules of the test, also focus on their testing strategy. They do this because the SAT gives you points if you answer questions correctly; no points if you don’t answer at all; and deducts points if you answer incorrectly. In other words, you lose points if you’re wrong…but not if you don’t answer. So the best testing strategy can be to skip questions you really don’t understand.

Money requires a similar strategy. If you make a correct decision with your money, you can build wealth. But if you make a wrong decision, the consequences can be more damaging than if you had not made a decision at all. To say that in a different way…not making a financial decision can be better than a bad financial decision.

Large numbers of underwater mortgages (where people owe more than their home is worth) and foreclosures are the consequences of bad decisions in pursuing subprime loans by both lenders and borrowers. Many families and our communities would have been better off if these bad decisions had not been made.

Being informed helps us make better decisions AND avoid making bad decisions. This is why OneUnited Bank believes financial literacy is so important.

Many people in the urban communities we serve are not as financially literate as they need to be. Many of us are first generation high school or college graduates, first generation homeowners or first generation business owners. Growing up, we did not learn about credit scores, cash flows, profits or investments. We must play catch-up because, as a banker recently said, although everyone may not know the rules… the rules still apply to everyone.

There are many sources for financial information. We recommend financial literacy websites from the FDIC (www.FDIC.gov/moneysmart) and the Federal Reserve (www.FederalReserveEducation.org).

OneUnited Bank also supports the JumpStart Coalition for Personal Financial Literacy® a coalition of organizations that share an interest in advancing financial literacy among students from pre-school through college (www.jumpstart.org). We also support Operation Hope’s Banking on Our Future® program which provides financial education for youth ages 9-18 at no cost to school districts, focusing on urban, under-served communities. (www.bankingonourfuture.org).

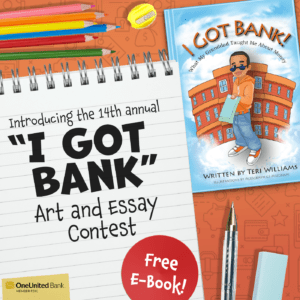

OneUnited Bank is promoting financial literacy for youth ages 8-12 with a new children’s book called I Got Bank! (www.oneunited.com/book). We hope the book can serve as a “hook” to get kids (and adults) to focus on financial literacy.

April is Financial Literacy Month. Take a positive step today to become more informed and help educate our youth and communities!