Black entrepreneurship goes beyond what we hear during Black History Month or on BlackOutDay. It is rooted in us from the very beginning of the fight for equality, social justice, and the right to build prosperity for our community. We celebrate Black entrepreneurship for its inspiring history of breaking barriers and generational cycles!

A bit of history

Establishing the roots of Black entrepreneurship was not easy. After slavery was formally abolished, business licenses were still difficult to obtain or not issued to Black Americans. In 1900, Booker T. Washington founded the National Negro Business League with the intention that the League would encourage the Black community to start businesses and enhance the commercial and economic prosperity of Black America. Some of the business communities that emerged – like Greenwood, better known as Black Wall Street – were leveled to the ground by white extremists. But we never gave up. As a community, we took every opportunity to shape and showcase our #BlackTalent, and when the internet era came in the 1990s, the stage was set for more Black professionals to dive into entrepreneurship.

According to the US Census Bureau, Black businesses are more than 124,500 strong with average revenues of $1,031,021 compared to $6,485,334 for non-Black businesses. The Selig Center for Economic Growth at the University of Georgia reports that Black consumers have a buying power of nearly $1.6 trillion in America today. Even with this incredible success Black entrepreneurs still have to overcome the difficulties of decades of inequality as well as racial and gender pay gaps. According to the report of McKinsey & Company, Black entrepreneurs start their businesses with about $35,000 of capital compared to their white counterparts who start at around $107,000. This shows the scale of the difficulties faced by our community.

2020 and 2021 were difficult years for Black entrepreneurship mainly due to the COVID pandemic that hit Black businesses particularly hard. We believe, however, we can overcome all difficulties when we are united and we put our #BlackExcellence to work! Black entrepreneurs are curious, conquer doubts, are consumer obsessed, learn from mistakes, and innovate at every turn – key traits that all successful entrepreneurs share.

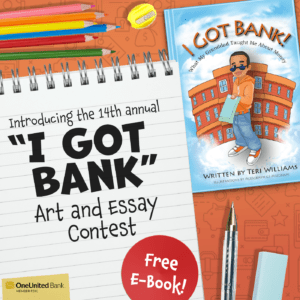

Entrepreneurial Inspiration

Today, there are so many successful Black entrepreneurs inspiring others to build generational wealth through business ownership. Oftentimes they are your neighborhood heroes who own beauty and skincare boutiques, barbershops, grocery stores, restaurants, accounting offices, insurance or financial start-ups, and many more – too many to list. Here are a few exceptional Black entrepreneurs that we want to highlight as a source of inspiration and encouragement.

Beatrice Dixon – the founder and CEO of the world’s first plant-based, feminine care natural products line. She was one of the first Black women entrepreneurs to raise $1 million in venture capital and was named one of Forbes’s top 100 Female Founders.

Tristan Walker – the Silicon Valley tech disruptor, founder and CEO of Walker & Company and its BEVEL brand designed with the Black community’s needs in mind. He was named Ebony Magazine’s 100 Most Powerful People and Black Enterprise’s “40 Next”.

Shareef Abdul-Malik – founder of the We Buy Black independent economic ecosystem – social media platforms and website aimed at making more Black entrepreneurs succeed. He has created the to-go place for our community actively seeking to support Black-owned companies and recycling millions back into Black businesses.

Daymond John – is a multi-millionaire business mogul, TV personality, motivational speaker, and ABC Shark Tank investor. He started his first successful business in his teens and was the CEO and founder of FUBU. He is committed and actively participates in the life of our community by promoting Black entrepreneurship. He was one of our guest speakers at the #OneTransaction Virtual Conference on Juneteenth.

Today we are more equipped to overcome systemic racism with our ability to embrace who we are and what we can do through our businesses – online and in-store. We can and we will rebuild Black Wall Street! Closing the opportunity gap for Black-owned businesses starts with acknowledging it and taking action. It starts with supporting local Black small business owners by providing the resources they need to grow and create opportunities for others to #BuildBlack. Let’s celebrate #BlackEntrepreneurship by supporting the #BuyBlack and #BankBlack movements today.